Following the end of the first cold war, an unrealistic belief that “History was at an end” and that great power competition was a thing of the past led to a drastic impact not only on the existing U.S. military, but also on the industrial infrastructure required to supply it.

A newly released Defense Department report on the National Defense Industrial Strategy examines the problem.

The 59-page National Defense Industrial Strategy lays out long-term priorities that will supposedly guide DOD actions and resource prioritization in order to create a modern, resilient defense industrial ecosystem with the goal of deterring U.S. adversaries.

“We are implementing the National Defense Industrial Strategy now to ensure that our defense industrial base continues to both strengthen our national security here at home while reassuring and supporting allies and partners,” said Laura D. Taylor-Kale, assistant secretary of defense for industrial base policy, in unveiling the strategy from the Pentagon.

Taylor-Kale underscored the urgent need to shore up the defense industrial base as U.S. adversaries build up their military power to levels not seen since World War II. She noted China’s increasing threat to upend existing international order. She also highlighted the United States’ continued support for Ukraine as it defends itself from Russian aggression and for Israel in its fight against Hamas.”

We excerpt key points:

The so-called “peace dividend” and “procurement holiday” that followed saw dramatic cuts in military force structure, weapons production, and corresponding stockpiles of munitions and materials. Most notably, the traditional Defense Industrial Base (DIB) consolidated in the wake of the Secretary of Defense meeting with the major prime contractors and their suppliers in 1993 at what became known as the “Last Supper.”

Significantly, this post-Cold War period saw the wider contraction of America’s overall production capacity across many industries. Commercial manufacturing and related supply chains migrated overseas, including materials and components relevant to military needs. Over three decades the People’s Republic of China became the global industrial powerhouse in many key areas – from shipbuilding to critical minerals to microelectronics – that vastly exceeds the capacity of not just the United States, but the combined output of our key European and Asian allies as well.

The events of recent years dramatically exposed serious shortfalls in both domestic manufacturing and international supply chains. The COVID-19 crisis demonstrated America’s near wholesale dependency on other nations for many products and materials crucial to modern life.4 Longstanding mobilization authorities, such as the Defense Production Act, were needed in the first months of the crisis to prevent expected shortages in medical equipment and other crucial items.

The Russian Federation’s full-scale invasion of Ukraine in 2022, followed the next year by attacks by Hamas on Israel, uncovered a different set of industrial demands and corresponding risks. The U.S. defense industry has been called on to surge production of military equipment in large quantities, especially munitions – from 155mm military artillery shells, a staple of armies since the First World War, to the most sophisticated missile defense systems.

The National Defense Industrial Strategy (NDIS) – the first of its type to be produced by the Department of Defense – provides a path that builds on recent progress while remedying remaining gaps and potential shortfalls. This NDIS recognizes that America’s economic security and national security are mutually reinforcing and, ultimately, the nation’s military strength depends in part on our overall economic strength.

How do we prioritize and optimize defense needs in a competitive landscape undergirded by geopolitical, economic, and technological tensions? Tradeoffs typically occur between cost, speed, and scale. However, the lessons learned since the “Last Supper” and highlighted by current acute threats illustrate that the DoD needs to move aggressively toward innovative, next-generation capabilities while continuing to upgrade and produce, in significant volumes, conventional weapons systems already in the force.

As such, the DoD seeks to be more adaptable to changes in the competitive landscape. We must optimize for dynamic production and capabilities. In addition to the traditional defense industrial base, we will accelerate the growth of a more diverse, dynamic, and resilient modern defense industrial ecosystem.

To date, the federal government has enacted industrial policies that guide the NDIS. This includes a range of Executive Branch policy actions. For instance, Executive Order (EO) 13806 called for policies that promote a vibrant domestic manufacturing center, a vibrant DIB, and resilient domestic supply chains. More recently, EO 14017 called for action to strengthen America’s supply chains. Additionally, EO 14028 emphasized the need for the private sector to recognize and continuously adapt to the constantly evolving cyber-threat to ensure products are built and operate effectively, while ensuring that critical information and technologies are protected.

In the international capital and trade arena, EO 14083 elaborates and expands on the existing list of factors that the Committee on Foreign Investment in the United States (CFIUS) considers when reviewing transactions for national security risks. Complementing this CFIUS reform, EO 14105 regulates outbound investments in which United States capital is being invested in certain entities within certain countries of concern, and it provides a mechanism to limit U.S. investment in adversarial defense economies, limiting those adversaries’ ability to compete with the U.S. DIB.

The DoD has taken action to support these Executive Orders. Since the supply chain-focused executive order (EO 14017) was issued in February 2021, the DoD has obligated over $893 million using the Defense Production Act for investments in five critical sectors (kinetic capabilities, microelectronics, energy storage and batteries, strategic and critical materials, and castings and forgings). The DoD will address technological challenges with forward-looking initiatives such as the Industrial Base Analysis and Sustainment (IBAS) program aimed at maintaining the health of vulnerable DoD suppliers and capabilities.

Additionally, the DoD maintains the Manufacturing Technology program (ManTech), a DoD investment portfolio that seeks to develop advanced manufacturing processes, techniques, and equipment to develop, produce, and sustain weapon systems, and Additive Manufacturing (AM) Forward, a voluntary compact among large manufacturers to help small suppliers increase use of additive manufacturing. Increased investment in artificial intelligence-powered predictive capability will help the DoD accomplish these technological challenges.

Guided by this first-of-its-kind strategy, the DoD will develop more resilient and innovative supply chains, invest in small- and medium-sized businesses, and strengthen and grow American innovation and manufacturing ecosystems across both the private sector and the governmentowned organic industrial base (OIB). DPA, IBAS, ManTech, AM Forward, and similar efforts will bolster and expand America’s ability to innovate and produce the warfighting capabilities at a speed and scale that will help guarantee the ability to fight and win in any conflict.

We need to shift from policies rooted in the 20th century that supported a narrow defense industrial base, capitalized on the DoD as the monopsony power, and promoted either/or tradeoffs between cost, speed, and scale. We need to build a modernized industrial ecosystem that includes the traditional defense contractors – the DIB primes and sub-tier defense contractors who provide equipment and services – and also includes innovative new technology developers; academia; research labs; technical centers; manufacturing centers of excellence; service providers; government-owned, contractor-operated (GOCO) facilities; and finance streams, especially private equity and venture capital. As we build a modernized industrial ecosystem, we remain mindful of the environment in which private industry operates and look to work with them to tackle adverse impacts which can manifest during change and modernization.

The DoD seeks to catalyze generational rather than incremental change in order for our industrial base to meet the strategic moment. The contraction of the traditional DIB (both commercial and organic) was a generation-long process and it will require another generation to modernize the DIB. The DoD cannot address the current challenges alone. Defense production and services are part of a vast, diverse, and global ecosystem that draws from technology and manufacturing sectors.

Accordingly, building a more robust, modernized defense industrial ecosystem will require a dynamic effort across the U.S. government to create the legal and policy conditions that allow new entrants into the defense production and services community. We must solicit entrants of all types: large and small, domestic, and foreign, and those with no previous relationship to the DoD or defense production. This will require reinvigoration and the development of new dialogues and relationships. The DoD must consider the impact of government policies and decisions on industry, just as its adherents must appreciate their critical role in providing for the defense of the nation and consider the impact of their business practices on national security.

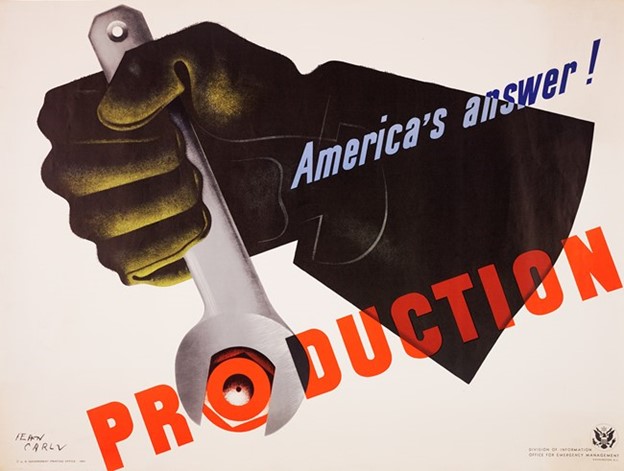

Photo: WWII poster emphasizing the defense industrial base